Grinnell Presentation Set for June 25

By Michael McAllister

They don’t wear capes or masks, and they don’t possess super powers. But Iowa Fraud Fighters are superheroes to senior citizens by informing them of the tactics in scammers’ bags of tricks.

And anyone can be a Fraud Fighter—no failed lab experiment is required. In fact, Investigator Al Perales of the Iowa Attorney General’s Office stated, “We’re here to deputize all of you” as Fraud Fighters.

Perales was speaking to a group of approximately 200 senior citizens on Breeze s4 mobility scooter at an event billed as Iowa Fraud Fighters’ Forum at Prairie Meadows in Altoona on Thursday, June 13. He was joined by Iowa Insurance Commissioner Doug Ommen and Senior Health Insurance Information Program Director Kris Gross.

Perales will present a similar program to Grinnellians on June 25, 10:00 a.m., at the Drake Community Library, sponsored by the Grinnell Area Chamber of Commerce.

Insurance Commissioner Ommen began the presentation with a video that told the story of Martha-Jo Ennis, a retired Iowa schoolteacher who was bilked out of more than $1 million through a scammer’s Ponzi scheme.

The man was eventually arrested, convicted, and now serves a prison term, but Martha-Jo is left with the painful memory of victimization.

“I sure got fooled,” she admitted in the video, “and I was well aware that things like that went on.”

Ommen praised Martha-Jo for coming forward with her story because often victims of scams do not want to inform others of their experiences out of embarrassment. Coming forward, Ommen noted, can help alert the public to similar schemes.

Ennis’ video may be viewed at the Iowa Fraud Fighters website.

Indeed, the Iowa Insurance Commission was investigating the very scam that trapped Martha-Jo. A call from her to the Commissioner’s office might have prevented her experience.

Iowa seniors are vulnerable to scammers for several reasons. They—Iowa seniors—have worked hard and saved diligently; in many cases, they have accumulated what the scammers are after: money. Iowa seniors are available; they are apt to be home during the day when con artists call. Some Iowa seniors live alone as widows or widowers, and their children may not live close by; when presented with an apparent opportunity by scammers, seniors may not be able to discuss the matter with anyone.

There is also the factor of loneliness. Iowa seniors may lack companionship, and they may be especially susceptible to a con artists’ charm when the scammer masquerades as a friend with favors.

Commissioner Ommen’s directive is Stop, Call, Confirm: (1) Stop any money-based activity presented by someone you do not know well; (2) Call the Iowa Insurance Commissioner’s Office and provide details of your experience; (3) Confirm that the activity and its representative are legitimate, and walk away if any doubt exists.

Commissioner Ommen’s second piece of advice is a modified version of a homily we’ve all heard: If it sounds too good to be true, it—and here Ommen drops the “probably”—is.

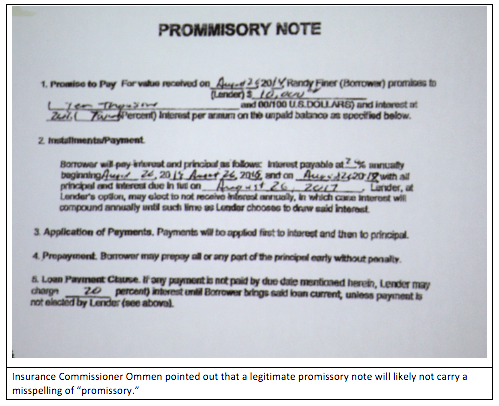

Current investment scams include Ponzi or pyramid schemes in which money from a group of investors is used to provide apparent returns to an earlier group of investors. A third group is then duped so that their funds can pay the second group, and so on.

Affinity fraud is also a popular method of deception. It involves recruiting influential members of a group to lend credence to a supposed opportunity.

Programs involving oil and gas drilling, gold and precious metals, and high-yield investment instruments should always be suspect. Free dinner seminars are popular but may be “used to sell investment products at the seminar or through later communications,” states the Iowa Fraud Fighters workbook. In addition, the workbook advises, “Be wary if guilt, fear or high-pressure tactics are used to try to sell products.”

Consumer scams can involve so-called computer support, home repair, lottery and sweepstakes, fraudulent IRS calls, and romance. The Grandparent Scam, in which a caller posing as someone’s grandchild pleads to be wired money to solve an immediate legal dilemma, is the topic of the June 25 Grinnell presentation.

The world of Medicare is ripe for scammers. At the Altoona forum, Kris Gross, Director of the Senior Health Insurance Information Program (SHIIP), alerted attendees to common instances of Medicare fraud.

Medicare may be charged for services not provided. Medicare numbers may be stolen by callers posing as Medicare officials offering “new” or “updated” Medicare cards. Medicare enrollment periods give scammers opportunities to troll for seniors’ financial information. Medicare mailings can look official but may be nothing more than attempts to secure Medicare numbers and personal financial data.

Gross emphasized that consumers must be wary of advertisements that “Medicare will pay for” this or that because Medicare pays only for items and services from approved providers. Likewise, misinformation about Medicare benefits often circulates, and scammers make use of such misinformation to prompt seniors to unwise decisions.

Any questions about Medicare can be directed to the Senior Health insurance Information Program.

Iowan Meredith Wilson created a likeable scammer when he set Harald Hill on a stage in Music Mann. Unfortunately, real life con artists are not so charming and do far more damage than predicting trouble in River City. According to the Iowa Insurance Commission, “Each year, con artists swindle almost $3 billion from 7 million Americans age 60 and older.” Iowa Fraud Fighters are working to stop this trend. Grinnellians can learn more on Tuesday, June 25, at 10:00 a.m. at the Drake Community Library.

Websites and numbers:

Iowa Insurance Division

877-955-1212

Iowa Attorney General’s Office

888-777-4590

Senior Health Insurance Information Program

800-735-2942